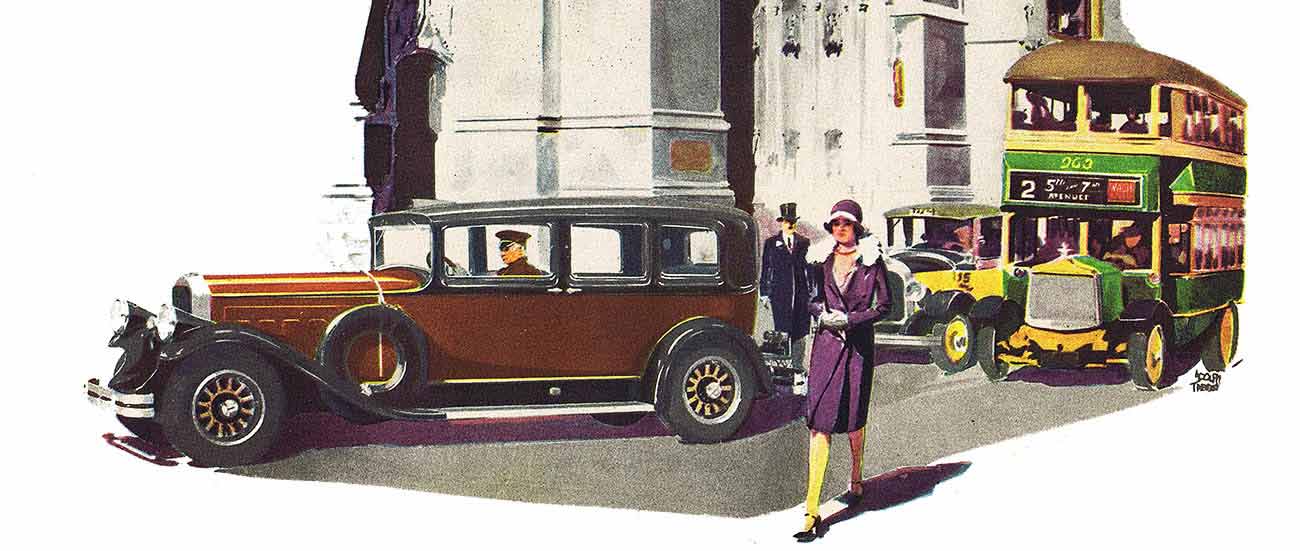

Fueled by easy money the nineteen-twenties were boom times like never before. The post-war recession was forgotten as everyone went on a spending spree. Credit, and not savings, enabled consumers to boost corporate profits to new levels.

Boom and Bust in the U.S. and World Economies

The 1920's saw new discoveries and inventions in nearly every field of endeavor that became the foundation of thriving businesses. Patent attorneys did a roaring trade and nearly every man fancied himself as an inventor if the number of patent submissions was anything to go by.

New business and production methods along with progressive business philosophies allowed manufacturers to boost turnover and to make large profits which they plowed back into new factories and wage rises. Department store and service station chains used massive buying power and operating efficiencies to lower prices while increasing service and choice, helping wages to go further. Henry Ford used his huge buying power to setup discount grocery stores selling cheap groceries for his employees, much to the annoyance of local store owners.

Increased incomes, along with the introduction of credit funded a huge increase in consumer spending. Only some of the increased affluence found its way into insurance as a provision for retirement.

There was an economic recession in 1921 but it was allowed to run its course without political interference and as a result it was over in 18 months. As the economy picked up, easy credit and speculation created stock market and property bubbles that had devastating effects when they eventually ended.

People living in the cities and areas of industry benefited most from the increased prosperity although there were arguments to the contrary. Those living in rural areas did not benefit to the same extent, and this was made worse by widespread drought. This encouraged population movement from rural areas to cities, a trend which has continued down to the present day. In 1926 alone the Department of Agriculture calculated that the nett migration in favor of the cities was over one million people.

Farmers banded together and incorporated their farms to achieve economies of scale in order to survive the hard times. All sorts of farmers from orchardists to wheat farmers formed corporations. Rather than a dozen farms each having their own tractor, truck, harvester etc, the corporation needed much fewer. Bulk purchases and sales reduced costs and increased marketing opportunities respectively.

Herbert Hoover, the Commerce Secretary, organized within the Department of Commerce a Bureau of Standards that promoted standardization of practices and equipment with the objective of reducing waste in time, labor, materials, and capital within certain industries. The standardization was necessary to help industry cope with the rapidly increasing demands being placed on it by consumer purchases.

Shoppers were able to buy big ticket consumer items like cars, fridges, washing machines, pianos, vacuum cleaners, furniture, and radios on time payment. Previously, these expensive items were only affordable by the wealthy. Advertising targeted at stay-at-home mothers was designed to persuade them that instant gratification through instalment plan purchases was the new ideal. Once one maufacturer or retailer offered instalment purchases the competition were forced to follow suit. About half of all instalment debt was for automobiles. It was estimated that 75 per cent. of all automobiles, 85 or 90 per cent. of all furniture, 80 per cent. of all phonographs, 75 per cent. of washing-machines, 65 per cent. of vacuum cleaners, 25 per cent. of all jewelry, and the greater part of all pianos, sewing-machines, radios, and electric refrigerators, were sold by partial payment. About $140,000,000 worth of clothing was also sold per annum on this plan. When British manufacturers saw how instalment selling had boosted American business they introduced "buying on tick" to Great Britain.

Rampant consumerism saw changes in advertising methods as businesses competed for the consumer dollar. Claude Hopkins, Bruce Barton, Edward L. Bernays and Ivy Lee were at the forefront of this new style of advertising where instead of listing a products specifications and qualities they stressed the benefits in terms of lifestyle improvement. These advertising men were so successful that politicians started using them to promote themselves, their party and policies, and so the spin-doctor was born. As advertising standards declined Commerce Secretary Hoover attempted to rectify the situation through a "Truth in Advertising" campaign designed to improve business ethics in managers of larger companies from the top down.

NOTE: Unlike the boom times in America, it should be pointed out that people living in Europe in the 1920's, Germany and Austria especially, suffered massive hyperinflation that destroyed the wealth of the middle class and led to political and economic turmoil in the affected countries.

The growth in number of millionaires is shown in Tax Reports by the Treasury Department, who reported that there were 21 individuals with an annual income of over one million dollars in 1921, 75 in 1924, and 207 in 1926. There were an estimated fifteen thousand U.S. millionaires in 1927, and at least one billionaire (cumulative nett worth), nearly four thousand of these living in New York, including three thousand living on or near Park Avenue.

The rich splurged on apartments on Park Avenue and filled them with antiques and expensive paintings. The upward spiral in prosperity seemed to have no end and as always happens in this situation the easy money found its way into speculation. Using borrowed money, speculators pushed up the price of houses, land and shares.

Bonds and Treasuries which had been one of the main investment vehicles were passed over in favor of speculating for quick profits in shares. The Share Market climbed to dizzy heights as speculators bought stocks on margin from Wall Street brokers and brokerage houses that sprang up everywhere. Following heavy advertising and well publicized successes, the general public who had never previously invested in stocks joined in looking for easy profits. Shares could be purchased for a down-payment of 10%, the remainder of the price being financed by a loan from the share broker. When stock prices eventually slumped many investors had to sell shares to meet "margin calls" forcing share prices to drop further, exacerbating the problem and leading to the Share Market crash of October and November 1929.

Financial transactions were at an all time high, especially cash transactions as people used dollar bills instead of larger denominations for everyday purchases like gas for their automobile. As a result dollar bills wore out faster than ever forcing the Government to print them at a faster rate. The Government tried to encourage everyone to use silver "cartwheel" dollars but their appeal fell on deaf ears as people preferred the lighter weight and convenience of paper.

It was no coincidence in this time of financial plenty that executive salaries ballooned to extravagant levels, widening the gap between management and the workers. Wall Street and the Banks grew fat on the fees involved in private equity buyouts and corporate mergers and paid large christmas bonuses to their staff. Business ethics collapsed and corruption was widespread at high levels in politics and business, leading to some high profile trials. One of these was the Doheny oil lease corruption scandal. These were all signs that the boom times were about to end.

From one extreme to the other - Boom to Bust. The magical prosperity vanished almost overnight as people lost confidence following the 1929 Stock Market crash, and despite everything that governments could do, America and much of the world slipped into a harsh depression that only ended ten years later with the start of World War 2.

At the beginning of the 20th century there were no federal income taxes in the United States. In 1908 President Roosevelt endorsed both income and inheritance taxes. In 1909 the income tax amendment passed through Congress and the last State ratified the Sixteenth Amendment on February 13th, 1913.

In April 1913 Pres. Wilson set an income tax of 1% on incomes above $3,000 and applied surcharges between 2% and 7% on income from $20,000 to $500,000. In 1914 the top tax rate was 7%, in 1916 it was 15%, in 1916 it was 67%, in 1917 it rose further to 77%. The top rate eventually fell to a low of 24% in 1929 but steadily increased again over the following decades. This taxation scenario was played out in most western countries as this comparison of British and U.S. taxes in 1930 shows.

The potential market in China with its 400,000,000 population was viewed as the opportunity of all opportunities by American businesses seeking to maintain growth in their industries and U.S. businessmen were encouraged to learn Chinese. Chinese imports were at the one billion dollar level in 1927 and growing at about 30% per year. American exports to China included kerosene and cigarettes.

Tariffs were used by most countries to protect their local industries by making it expensive for overseas competitors to do business. American tariff law set up to protect American businesses contained a uniform schedule of rates for all countries and prescribed penalties when a country attempted dumping or unfair discrimination against American trade. Because it was relatively inflexible it created more problems than it solved and led to trade wars with countries like Canada and France. Due to its financial and military muscle, the U.S. was able to influence the tariff levels in other countries like China.

Coal was the primary fuel for heating and cooking in the home and also to feed the furnaces powering the boilers of factories and ships, although oil was starting to make inroads. Coal-mining was an important strategic industry that employed thousands of miners, many who died prematurely in accidents or from lung related disease caused by dust.